MBA Purchase Index Shows 2024 Housing Market Slowdown: What the Numbers Mean

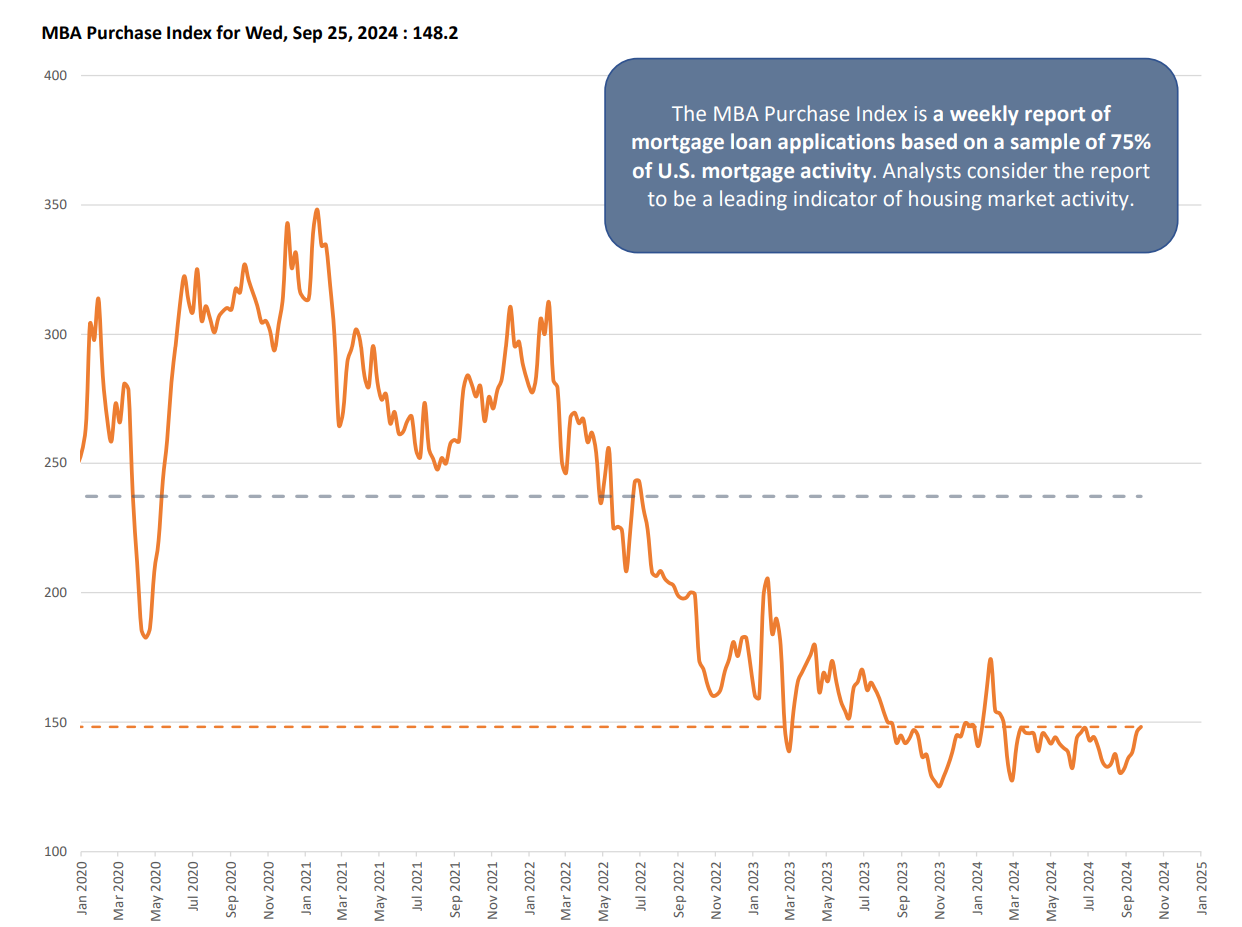

September 26, 2024: The Mortgage Bankers Association (MBA) Purchase Index is a critical indicator of the housing market, providing valuable insights into the volume of mortgage loan applications across the United States. This index is updated weekly and is based on a sample that represents 75% of the U.S. mortgage activity, making it one of the most reliable tools for analyzing trends in the housing sector. As of September 25, 2024, the MBA Purchase Index stands at 148.2, continuing a downward trend observed over the past several months.

Historically, the MBA Purchase Index has experienced significant fluctuations, often reflecting broader economic conditions and shifts within the housing market. In the early 2000s, the Index consistently remained above 300, peaking at 475.7 in 2005, during the housing boom. However, following the financial crisis of 2008, the Index began to drop sharply, reaching a low of 196.5 in 2010. This dramatic decline mirrored the collapse of the housing market during the Great Recession, a time marked by decreased consumer confidence, stricter lending criteria, and a slowdown in home sales.

In the years following the recession, the MBA Purchase Index showed signs of recovery, particularly in 2021, when the Index reached a median of 278.1. This recovery was fueled by low interest rates and a post-pandemic surge in home buying activity. However, since 2022, the Index has once again been on a downward trajectory. The 2023 median was recorded at 161.3, and the current 2024 figures show a continued decrease, with the September 25, 2024, index at 148.2.

Several factors contribute to this sustained decline. One of the most significant reasons is the rise in interest rates, which has made borrowing more expensive for potential homebuyers. Additionally, inflationary pressures have eroded purchasing power, making it harder for consumers to afford homes. These challenges have dampened the demand for mortgages, as reflected in the steady decline of the . Furthermore, as housing prices remain elevated in many markets, affordability has become a significant barrier, reducing the pool of qualified buyers and leading to fewer mortgage applications.

Looking deeper into the data, it’s clear that the housing market in 2024 is much more restrained compared to previous years. The 2024 index of 142.3, the lowest since the 2023 figure of 161.3, underscores the current difficulties facing both buyers and sellers. As mortgage rates remain high, many potential buyers are hesitant to enter the market, fearing that their monthly payments will be significantly higher than in previous years. This hesitation is reflected in the lower volume of mortgage applications.

The MBA Purchase Index not only highlights trends in housing demand but also serves as a reflection of the overall economic climate. As consumer confidence fluctuates and financial conditions tighten, the demand for housing will continue to ebb and flow. The consistent decrease in the Index from 2023 to 2024 is a clear indication that the housing market is facing headwinds, particularly as potential homebuyers grapple with higher interest rates, inflation, and affordability concerns.

In conclusion, the MBA Purchase Index is a vital tool for understanding the state of the housing market. The September 25, 2024, figure of 148.2 paints a picture of a housing market under pressure, with fewer buyers able to afford homes in the current economic environment. As interest rates remain elevated and inflation persists, it is likely that this trend will continue, at least in the short term, making it critical for potential buyers and industry professionals to closely monitor this important index.